Are Nonprofit Financial Records Public

Are a nonprofit's finances public information? | Nolo

Nonprofits must allow public inspection of these records during regular business hours at their principal offices. However, many people won't even need to ask -- a number of websites make Forms 990 available for the searching, including the Foundation Center at http://fdncenter.org and GuideStar at www.guidestar.org.

https://www.nolo.com/legal-encyclopedia/question-are-nonprofits-finances-public-information-28028.htmlAre nonprofit financials public record? – AnswersToAll

Nonprofit corporations must submit their financial statements, which include the salaries of directors, officers and key employees to the IRS on Form 990 as mentioned above. This means that nonprofits must make their records available for public inspection during regular business hours at their principal office.

https://answer-to-all.com/language/are-nonprofit-financials-public-record/

Public Disclosure Requirements for Nonprofits

Public Disclosure Requirements for Nonprofits Printer-friendly version Tax-exempt nonprofits are required to provide copies, upon request, of their three most recently filed annual information returns (IRS Form 990) and their application for tax-exemption.

https://www.councilofnonprofits.org/tools-resources/public-disclosure-requirements-nonprofits

Nonprofit Tax Returns Public Record: Everything You Need to Know

The public is allowed to request financial information about nonprofits by submitting Form 990. Both the nonprofit itself and the IRS are legally required to provide this information once it has been requested. During normal business hours, nonprofits must allow any member of the public who asks to inspect their records.

https://www.upcounsel.com/nonprofit-tax-returns-public-record

Are Nonprofit Corporations Required to Make Financial Statements Public ...

Yes, nonprofit corporations are required to make their financial statements available to the public. Form 990 includes a nonprofit’s figures for revenue, expenses, assets, and liabilities, and all 501 (c) (3) nonprofits are required to submit Form 990 to the IRS annually.

https://www.legalnature.com/guides/are-501c3-nonprofit-corporations-required-to-make-their-financial-statements-available-to-the-public

Are 501(c)(3) Financial Records Public? - Finance Strategists

Yes, 501 (c) (3) financial records are public information. A 501 (c) (3) organization is required to provide information on salaries and other financial statements to the IRS through form 990, which is required to be published by the IRS regularly. Determining if 501 (c) (3) Financial Records Are Public FAQs What is a 501 (c) (3) organization?

https://learn.financestrategists.com/finance-terms/501c3/are-501c3-financial-records-public/

Where to Find Nonprofit Financial Information | Bridgespan

Search for annual reports on GuideStar or the nonprofit's website. All nonprofits with $100K in annual contributions or over $250K in assets are required to file an IRS Form 990. The Form 990 is publicly available and can be found on the organization's page or on nonprofit databases such as GuideStar. (Note that the database is not comprehensive.)

https://www.bridgespan.org/insights/library/philanthropy/where-to-find-nonprofit-financial-information

Financial Transparency | National Council of Nonprofits

Earning trust through financial transparency and accountability goes beyond what the law requires, but let’s start there: Nonprofits are required to disclose certain financial information to the public upon request; board members have access to financial information in order to fulfill their fiduciary duty to the nonprofit.

https://www.councilofnonprofits.org/tools-resources/financial-transparency

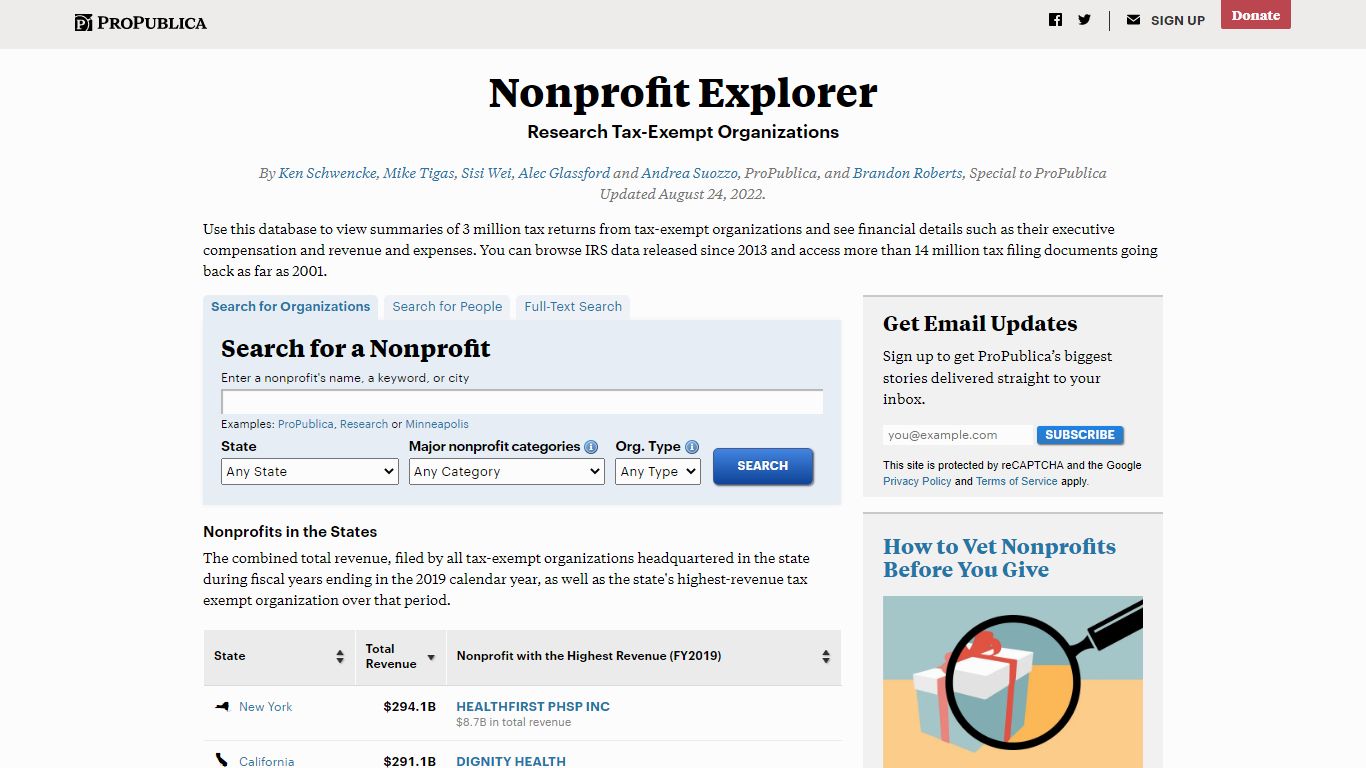

Nonprofit Explorer - ProPublica

Use this database to view summaries of 3 million tax returns from tax-exempt organizations and see financial details such as their executive compensation and revenue and expenses. You can browse...

https://projects.propublica.org/nonprofits/

GuideStar nonprofit reports and Forms 990 for donors, grantmakers, and ...

Quantity. Easily search 1.8 million IRS-recognized tax-exempt organizations, and thousands of faith-based nonprofits Gather insights on financials, people/leadership, mission, and more

https://www.guidestar.org/

Recordkeeping Basics for Nonprofits - Foundation Group®

Nonprofits that are required to file Form 990 or 990-EZ are required to list on Schedule B all donors who gave $5,000 or more, assuming those donors are individuals, companies, or non-public charity nonprofits. For some nonprofits, the threshold for listing larger donors is 2% or greater of donated revenue.

https://www.501c3.org/recordkeeping-basics-for-nonprofits/

Good Financial Records: A Must for Every Nonprofit

Section 501 (c) (3) charities must “maintain books and records” to “ensure that they continue to be recognized as tax-exempt ….”. At a minimum, these books and records must show “sources of receipts and expenditures” and whether a group is a public charity or a private foundation. They must be adequate enough so the organization ...

https://www.fplglaw.com/insights/good-financial-records-must-every-nonprofit/